8/10 Lam Research (LRCX): A Strong Bet in the Semiconductor Equipment Space

- vand3rdecken

- Mar 8, 2024

- 2 min read

Intro

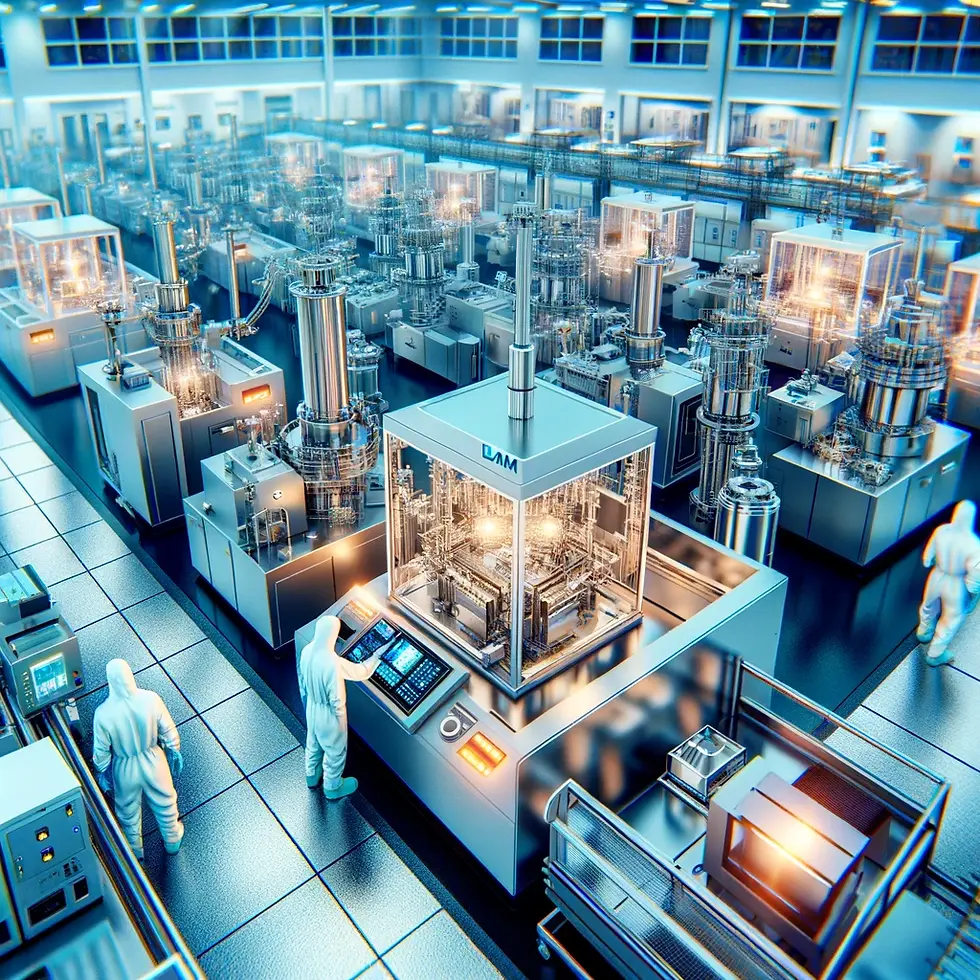

Lam Research Corporation, a leader in the semiconductor equipment industry, demonstrates robust growth and financial health. Its strategic positioning and financial metrics suggest a compelling case for investment.

Revenue Growth

Lam Research has shown consistent growth in revenue, with recent quarters outperforming expectations. This growth is driven by strong demand in the semiconductor industry, particularly in areas like artificial intelligence and memory.

Score: 8

Margin/Net Income

The company's profitability metrics, including net income margin and return on equity, are impressive, significantly outperforming sector averages. This indicates efficient operation and robust profitability.

Score: 9

Balance Sheet Strength

Lam Research's balance sheet is strong, with a high level of cash and cash equivalents, and a solid return on equity. The company's financial health is bolstered by substantial cash flows from operations.

Score: 8

Growth Perspective

The semiconductor equipment sector is expected to continue growing, with Lam Research well-positioned to benefit from trends in AI and memory. Analysts are optimistic about the industry's outlook, projecting continued expenditure and innovation.

Score: 8

Stock Performance Trend

LRCX's stock has shown a positive trend, reflecting the company's operational success and the industry's growth potential. Its performance is aligned with broader technology sector trends, showing resilience and potential for further gains.

Score: 7

Valuation Metrics

Despite its growth, Lam Research trades at a reasonable valuation compared to peers. Its P/E ratio is aligned with industry averages, suggesting the stock is not overvalued given its growth prospects.

Score: 8

Summary

Lam Research stands out as a strong investment within the semiconductor equipment industry, supported by solid financials, strategic market positioning, and a favorable industry outlook. Its balanced approach to growth and profitability, combined with a healthy balance sheet, presents a compelling case for investors.

Final Score: 8

Comments